We strongly believe in hiring people greater than ourselves. We recognize, reward, and develop those individuals who make an outsized impact to the business. Our combined passion, hard work, and proactive thinking allows us to simultaneously empower our clients and each other.

Every role at Fortis Bank is connected to our company strategy and can drive high impact. As a result, we have assembled top talent from a diverse set of industries, including financial services, hospitality, technology, and consulting.

At Fortis, you will have the opportunity to both drive huge impact and partner with some of the incredible talented people on our team.

We believe employees should be empowered to drive impact through clearly stated competencies.

Strong personal results

Supports others to help them deliver impact

Learns from others inside and outside of the company

Thinks ahead, anticipates opportunities, and acts to find/implement solutions

Unwavering faith in our company’s ability to achieve

Positive outlook and attempts to turn any negative situation into a positive one

Gladly wears many hats and adapts to change with a smile

Applies themselves to the best of their ability and works hard

Displays true passion as part of the team, goes above and beyond to drive results

Does not require continuous checking up on progress

Lives and breathes the company principles

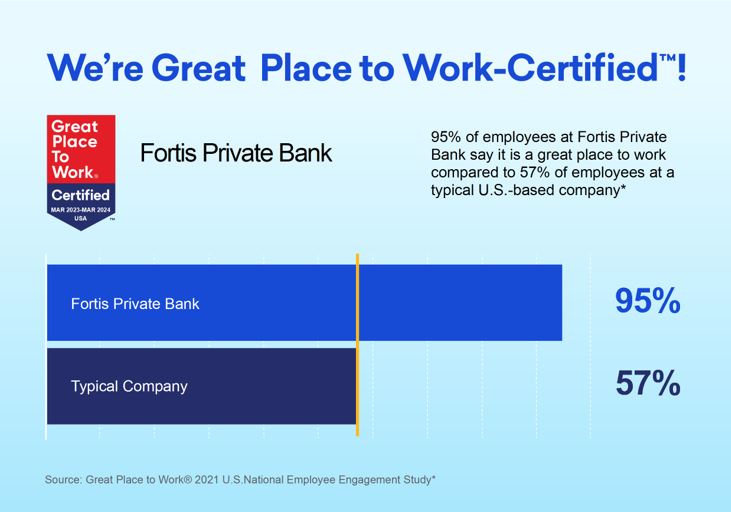

Looking to grow your career at a company that puts its people first?

Search Open PositionsYou will be linking to another website not owned or operated by Fortis Private Bank. Fortis Private Bank is not responsible for the availability or content of this website and does not represent either the linked website or you, should you enter into a transaction. We encourage you to review their privacy and security policies which may differ from Fortis Private Bank.